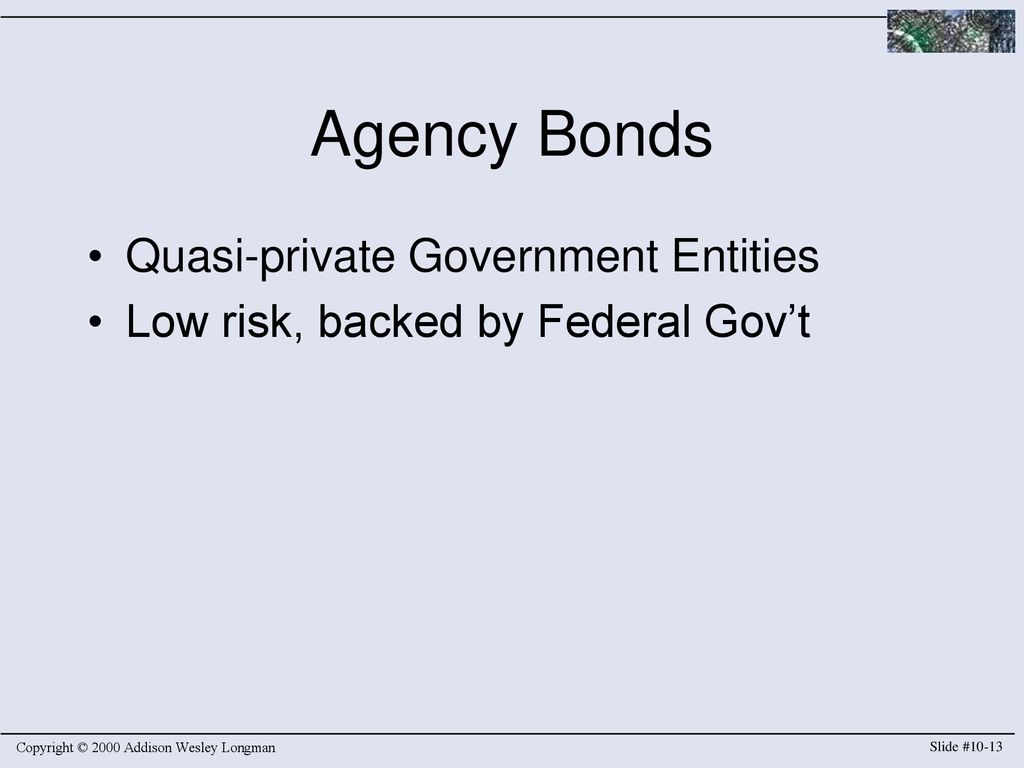

Agency bond tax feature A question that we see regularly is regarding the tax feature of agency bonds The interest income from agency bonds are subject to both federal and state taxes Interest on certain agencies, including ones issued by FHLB, and FFCB, is exempt from state taxes Municipal Bonds A ladder approach in a rising rate environmentPar –Bonds are commonly issued at Par or (100% of the maturity value) Discount–Bonds can also trade a price below Par or at a discount The price of a discounted bond would be below , increasing your YTM Premium –Bonds can also be traded at premium price levels, or a price above Par, decreasing your YTMThe retail bonds are not deposits of a Farm Credit System bank or association, and are not insured by the FDIC or any other US agency The bonds are subject to investment risk, including the possible loss of principal and value This information does not constitute an offer to sell or a solicitation to purchase Farm Credit retail bonds

Over Investing In New Issue Agency Callable Bonds Sin 1

Ffcb agency bonds

Ffcb agency bonds-The iShares Agency Bond ETF seeks to track the investment results of an index FFCB 574 FHLMC MTN 555 FFCB 412 FNMA BENCHMARK NOTE 332 FHLMC MTN 265 FNMA BENCHMARK NOTE 245 6506 Holdings are subject to change GLOSSARY Weighted Average Maturity is the length of time until the average security Traders who would like to explore the FFCB bonds, can add them to the USD Agency sheet Traders can analyze these bonds and see their spread to the matched treasury, Libor, SOFR and see carry and roll To add these bonds, click on the "Ticker" box and select "FFCB" Then hit "Apply" This will load the bonds

Tustin Granicus Com

In the example above, the FFCB bond is offered at a 23 basis point spread (476% 453% = 023%) over the Treasury bond, and the PEFCO bond at just over a 22 basis point spread Like Treasury securities, federal government agency bonds are backed by the full faith and credit of the US government An investor receives regular interest payments while holding this agencyDCMA's Fixed Income Division is a market maker in US treasuries, governmentsponsored enterprises (GSEs FNMA/FHLB/FHLMC/FFCB), agency mortgagebacked securities, investment grade corporate bonds, and repo and reverse repos

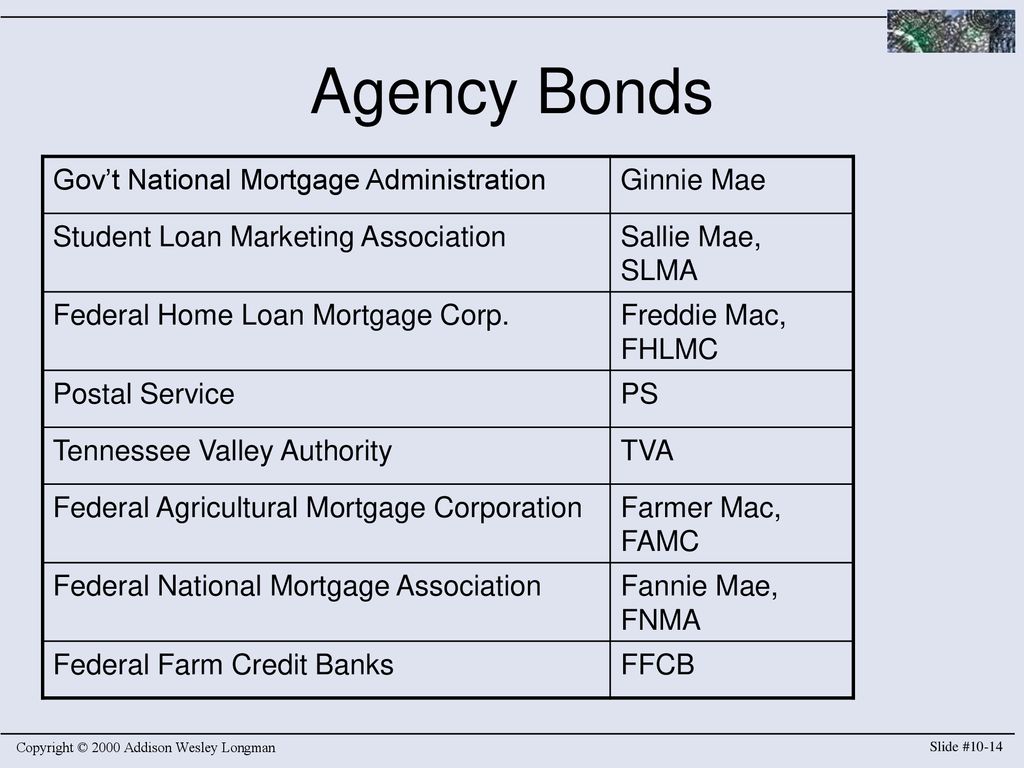

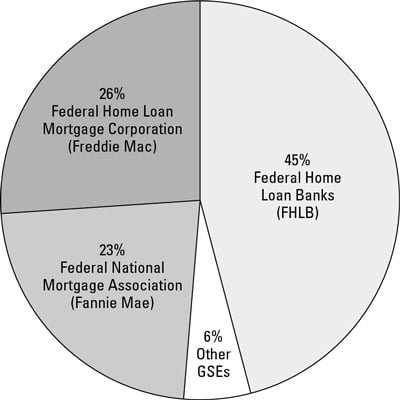

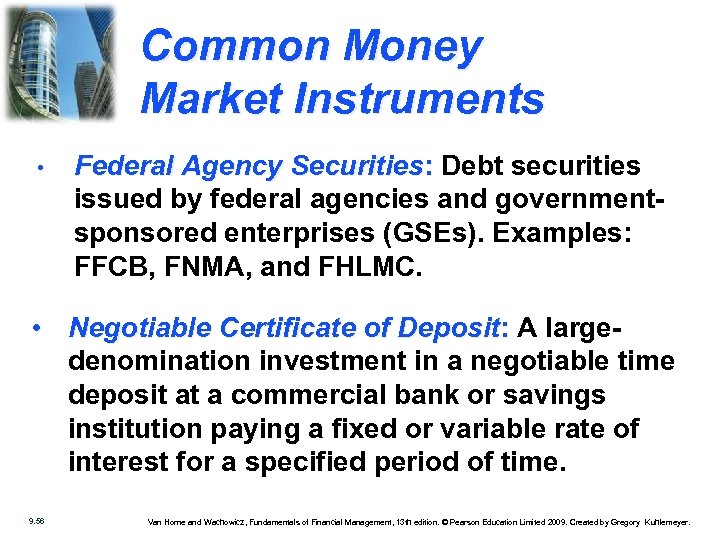

Brean Capital's MBS & Rates division provides sales, trading, banking and advisory services on a wide range of mortgage and assetbacked securities, US Treasury and government agency securities, structured products such as CLOs and CDOs, whole loans, and other securities Trading volume is over $100 billion in securities annually, and MBSOthers bonds are issued by FHLB, FFCB and a few others Types of Agency Bonds Straight Debt Obligation These bonds are backed by the full faith and credit of the agency and generally pay interest from a nominal yield every 6 months with a fixed maturity where the par value is redeemedAgency bonds are issued by either a governmentsponsored enterprise (GSE) or a governmentowned corporation, and are debt obligations solely of the issuing agency GSEs include Federal Home Loan Bank (FHLB), Federal Farm Credit Bank (FFCB), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC)

Although they carry a government guarantee (implicit or explicit), agency bonds trade at a yield premium (spread) above comparable Treasury bonds In the example above, the FFCB bond is offered at Moreover, individuals seeking to potentially invest in FFCB bonds should be aware that investments in agency securities are subject toAll government agency securities are subject to federal taxes Corporations and individuals are taxed differently at the state level For individuals, all Federal Home Loan Bank and Federal Farm Credit Bank bonds are exempt from state and local taxes Corporations may be exempt from

Losgatosca Gov

App Collierclerk Com

Sub Total / Average US Agency MBS US Agency Bonds FFCB 012 3133EMML3 FFCB 0125 3133EMUH3 FFCB 015 9/9/22 3133EL6R0 9/9/22 FFCB 016 3133EMD FFCB 023 3133EMNG3 FFCB 025 3133EMHR6 FFCB 025 5/6/22 3133ELYR9 5/6/22 FFCBAnd 2) Federal Government agencies which may issue or guarantee these bonds—to finance activities related to public purposes, such as increasing home ownership or providing agricultural assistanceGovernment Agencies MultiBank Securities, Inc is an approved underwriter for Fannie Mae, Freddie Mac, Farmer Mac, the Federal Farm Credit Banks (FFCB) and the Federal Home Loan Banks (FHLB) Our Agency Trading Desk is made up of professionals who have significant experience in both the primary and secondary markets

Fn Capital Markets

Tustin Granicus Com

In the table below, we see two hypothetical agency bonds that are offered for sale by a bond dealerFederal Farm Credit Bank (FFCB) is a GSE, thus carrying an implicit guarantee on its debt, while Private Export Funding Corp (PEFCO) bonds are backed by US government securities (held as collateral), and the interest payments are considered an explicit obligation of The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called For more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity date •FNMA, FHLB, FAMCA, FFCB, FHLMC •Municipal Bonds •Bullet Agency •Callable Agency •StepUp Agency •Municipal 12 Treasury DES 13 Treasury YAS 14 Treasury Cash Flow 15 Agency Discount Note Fhlmc Rates 16 Agency Discount Note Des 17

Sarasotafl Gov

Agz Ishares Agency Bond Etf Portfolio Holdings 13f 13g

The Federal Home Loan Bank, the Federal Farm Credit Bank and the Tennessee Valley Authority are state and local tax exempt Bonds offered by these agencies can offer a substantial premium to Treasuries for a taxable investors Most agency bonds are callableForeign Bonds Money Market Mutual Funds Municipal Bonds State Bond Issues US Agency MBS US Agency Bonds US Treasury Bonds / Notes Total / Average Portfolio Holdings as of Portfolio Holdings as of Page 2Callable Bond Auctions Once per day, the FHLBank may offer selected callable bonds to a designated group of dealers via competitive auction The structures offered could be of any size, maturity and lockout, but all would be "American" style with a 30/360 daycount, minimum denomination of $10,000 and multiples of $5,000, and callable with 5

Ice Tmc What S New Previous Enhancements

Tos Ohio Gov

The interest income on agency bonds generally is subject to federal and state taxes Interest on certain agency bonds, including securities issued by the FHLB and FFCB, is exempt from state taxesAgency bonds, when bought at a discount, may subject investors to capital gains taxes when they are sold or redeemedBond Education Background on Bonds Institutions of all sizes invest in agency bonds More than 2,500 credit unions nationwide currently hold bonds, from small credit unions with a few million dollars in investments to the largest credit unions with substantial securities portfolios(and Agency Bonds) What you need to know about the risks of fixed income investing Traditionally considered highquality, incomegenerating vehicles, governmentsponsored enterprise securities typically offer relative safety, predictable income

Ice Tmc What S New Previous Enhancements

Chapter Ten The Capital Markets Ppt Download

The System Banks utilize a fiscal agent, the Federal Farm Credit Banks Funding Corporation, to issue, market, and handle the Farm Credit Debt SecuritiesThe Funding Corporation, established by Congress and owned by the System Banks, is located in the greater New York City areaHow are callable agency bonds taxed? For the remaining US$350B in legacy cash bonds linked to LIBOR that exist past 21 listed on Bloomberg, other banks can view the FFCB exchange as a potential model for their own situationsThe widespread support from investors tells us that there is demand from the market, as well as from issuers who may want to remove ambiguity and legal risk

Sandiego Gov

Cdiacdocs Sto Ca Gov

The interest income on agency bonds generally is subject to federal and state taxes Interest on certain agency bonds, including securities issued by the FHLB and FFCB, is exempt from state taxes Agency bonds, when bought at a discount, may subject investors to capital gains taxes when they are sold or redeemedCall Schedule This page lists all bonds eligible to be called in full or in part for the next five business days If a bond will not be called on its call date, the figure in the Amount Redeemed column will be 000 If there is an amount in this column, then the bond is being called at least in part The Applicable Factor specifies how much of The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called For more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity date

Over Investing In New Issue Agency Callable Bonds Sin 1

Silo Tips

For US Treasury purchases traded with a Fidelity representative, a flat charge of $1995 per trade applies A $250 maximum applies to all trades, reduced to a $50 maximum for bonds maturing in one year or less Rates are for US dollardenominated bonds;Unsecured bonds issued by Fannie Mae, Freddie Mac, FFCB, and FHLB are referred to here as "GSE bonds" Although GSE bonds are not formally backed by the full faith and credit of the United States, due to their association with the federal government, GSE bonds benefit from an implicit federal guarantee3128xp6 fhlmcga agency bond freddie mac 3128x8db5 fhlmcgb agency bond freddie mac ga41 ffcbba agency bond federal farm credit banks 3133xrma5 fhlbga agency bond federal home loan banks mc50 fnmaca agency bond federal national mortgage association mfs7 fnmagt agency bond federal national mortgage association 3136f7bd8 fnma

Buttecounty Net

Agz Ishares Agency Bond Etf Etf Channel

Bond & Cap Proj Agency Bond FFCB 11/23/ 523 days 4,007,640 4,007,640 199% N/A Ladenburg Operating Agency Bond FFCB 11/30/ 530 days 4,014,1 4,014,1 196% N/A MultiBank Operating US Treas Bond TNote 11/30/ 285 days 4,000,691 4,000,691 152% N/A SamcoAdditional fees and minimums apply for nondollar bond trades Some of the Agency/GSE bonds enjoy the same state income tax exemption as Treasurys Since I live in a state with high state income tax, I only buy bonds from these issuers, namely Federal Home Loan Banks (FHLB) Federal Farm Credit Banks (FFCB) Tennessee Valley Authority (TVA) because the interest on their bonds are exempt from state income tax

Acgov Org

Bankprospect Com

Fixed Income DCMA's Fixed Income Division is a market maker in US treasuries, government sponsored entities (GSEs FNMA/FHLB/FHLMC/FFCB), agency mortgagebacked securities, investment grade corporate bonds, and repo and reverse reposThe Funding Corporation is not responsible for the content set forth on the website you are about to enter No judgment or warranty is made with respect to the accuracy, timeliness or suitability of the content or the information on the website you are about to enter, including any information regarding the Funding Corporation, and the Funding Corporation takes no responsibility thereof Includes bonds issued by GSEs, such as Federal Farm Credit Bank, Federal Home Loan Bank, Freddie Mac and Fannie Mae, and by wholly owned government corporations that Edward Jones currently offers

Oregon Gov

Treasurer State Md Us

Dec 1995 Feb 059 years 3 months Memphis, Tennessee Purchase bonds for inventory and merchandised sale of agency bonds (FNMA,FHLMC, FHLB, FFCB) to middle markets sales force and other dealersMakes T bill quotes comparable to T notes and bonds Uses T bill's price vs face value and 365 day year Bond equivalent yield formula BEY = D/P(365/t) (FFCB) Agency Issues have very _____ credit quality high Self funded govt AGENCY Largest public US power system Obtains funds from operating revenues and capital markets TVA bondsCurrently based in NY working at an exciting fintech company focusing on B2B payments and corporate charge cards 10 years of experience as a hedge fund investor in

Treasurer Ca Gov

Townofross Org

Ligation) to redeem the bond after a specified lockout period The issuer of a callable bond has an incentive to redeem the bond (exercise the call option) when the marketdetermined yield of a comparable new issue drops adequately below the yield on the outstanding bond2 For example, a 5year agency bond might be issued with aBanking local just got a little easier First Federal Community Bank Flip Kit is a stepbystep checklist to help make your transition to a new First Federal Community Bank account quick andA federally chartered but privately owned corporation which traces its roots to a government agency created in 1938 to provide additional liquidity to the mortgage market Today, Fannie Mae carries a congressional mandate to promote a secondary market for conventional and FHA/VA single and multifamily mortgages Fannie Mae is a publicly held

Ok Gov

Ttc Lacounty Gov

Agency Bonds Agency bonds are issued by two types of entities—1) Government Sponsored Enterprises (GSEs), usually federallychartered but privatelyowned corporations;Ffcb Collateralized Mortgage Obligations (CMOs) investmentgrade bonds, backed by mortgagebacked securities with a fixed maturity, that separate mortgage pools into different classes, orTSBM95 (4) I Income Tax 4Subject to New York Agency and Obligations State Income Tax InterAmerican Development Bank Bonds Yes

Ice Tmc What S New Previous Enhancements

3

/GettyImages-1018059526-ab2c0ee822c74297a255c21faf038a89.jpg)

Agency Bond Definition

Government Amp Corporate Bond Funds

Treasurer Ca Gov

Co Okaloosa Fl Us

Tos Ohio Gov

Sandiego Gov

Econnectdirect Fixed Income And Bonds

Chapter Ten The Capital Markets Ppt Download

Cityoflamesa Us

Nmsto Gov

Co Josephine Or Us

Naplesgov Com

Freddiemac Com

Cdn Ymaws Com

Ice Tmc What S New Previous Enhancements

The Commerce Funds

Agendas Baytown Org

Interest Rate Risk Measurement Alloya Corporate Federal Credit

Ok Gov

1

Tustin Granicus Com

What We Do Daiwa Capital Markets America Inc

Bosagenda Countyofventura Org

vwd Org

Test Co Jefferson Wa Us

Www1 Nyc Gov

Cor Net

Co Okaloosa Fl Us

Bond Math 101 Gfoat Fall Conference

Sarasotafl Gov

Cityoflamesa Us

Tustin Granicus Com

Naplesgov Com

Ocvector Org

Gioa Us

Mynevadacounty Com

What Are Agency Bonds All About Dummies

Future Securities Claims Government And Quasi Government Bonds

Slocity Org

Chapter 9 Cash And Marketable Securities Management Ppt Download

Ecommons Cornell Edu

Platinum Bond Reporting

The Effects Of Government Sponsored Enterprise Gse Status On The Pricing Of Bonds Issued By The Federal Farm Credit Banks Funding Corporation Ffcb Emerald Insight

How A Callable Bond Worked

Santafenm Gov

Sbafla Com

Sandiego Gov

Investment Concept Fundamentals California Debt And Investment Advisory

The Effects Of Government Sponsored Enterprise Gse Status On The Pricing Of Bonds Issued By The Federal Farm Credit Banks Funding Corporation Ffcb Emerald Insight

Intermediate Fixed Income Course Learn Bonds Cfi

Treasurydirect Gov

Corporate

Investment Concept Fundamentals California Debt And Investment Advisory

Fp 485apos Htm

Sarasotafl Gov

Cityofalbany Net

Chapter 9 Cash And Marketable Securities Management 9

Countyofsb Org

Countytreasurer Org

Countyofsb Org

Treasurer Ca Gov

Ice Tmc What S New Previous Enhancements

Platinum Bond Reporting

9 1 Chapter 9 Cash And Marketable Securities Management C 01 Prentice Hall Inc Fundamentals Of Financial Management 11 E Created By Gregory A Kuhlemeyer Ppt Download

Are Gnma Bonds Tax Exempt

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

Countytreasurer Org

Cityofalbany Net

Ebmud Com

Ebmud Com

Ftp Publicdebt Treas Gov

Investment Options For Advance Refunding Escrow Baker Tilly

Econnectdirect Fixed Income And Bonds

Multi Bank Securities Inc Government Agencies Multi Bank Securities Inc

Government Sponsored Enterprise Debt Securities Fixed Income Raymond James

Prospertx Gov

Ttc Lacounty Gov

0 件のコメント:

コメントを投稿